It offers trading on cryptocurrency, forex, and CFD assets, servicing traders within the European Economic Area, excluding Belgium. Outside of the European Economic Area, its services are run by another company under the same umbrella called Richfield Capital Limited. 24option does not charge any fees or commissions from investors when they make their initial deposit or purchase options. Withdrawals that are done via Wire transfer are charged with a fee of $30. The Basic, Silver and Gold account holders are allowed one free withdrawal per calendar month.

For instance, traders with a basic account must pay a €10 fee per month. Another fee which applies to all accounts is the account inactivity fee which kicks in after two months of inactivity. This fee can raise up to an outrageous €200 per month if the account is inactive for many months. Also, a €50 fee will be charged if you withdraw your funds after making only one trade.

Access to the Financial Market

Instead, you have to download the demo/live platform directly from the website. This guide will provide you with detailed information about AvaTrade, from copy trading to MetaTrader4. On its website, beginner traders can largely benefit from the whole instructional material offered.

THE METATRADER 4

In fact, 24Option UK offers free access to big publications on popular subjects like day-to-day market and technical analysis. The minimum balance required for this account type is $250, but the benefits you receive are minimal. With a Basic account, you’ll get beginner-friendly educational material and daily news. To open a live trading account, you need to meet a minimum initial deposit of $100.

- The sign-up process is quick and easy, and traders can start playing with the platform as soon as possible (except when trading is closed for a particular market).

- These tools can be helpful in making longer-term trading decisions and 24Option is at a competitive disadvantage when it comes to offering these services.

- As for CFD trading, traders have access to 132 stocks, 42 currency pairs, 13 commodities, 18 indices, and 5 of the most popular cryptocurrencies.

- The website and the app also have SSL protection, so no financial or other pertinent data is leaked or stolen.

- In addition, the broker has established a reputation as being one of the leading names in the industry.

In addition to binary and options assets, 24Option offers other assets, like CFD stocks and Forex, some of the most popular assets. We offer impartial reviews of online brokers that are hand-written, edited and fact-checked by our research team, which spends thousands of hours each year assessing trading platforms. 24Option offers two types of trading platforms, a proprietary platform called Scipio and the MetaTrader 4 platform. For day traders, 24Option is ideal as the broker is able to provide the right selection of underlying assets for day traders to trade with. For example with binary options, you can trade in contracts with an expiry time as short as 60 seconds.

Minimum Deposit and Withdrawals

All in all, we think that this trading platform is trustworthy and probably worth a shot. Doing just2trade review banking with this broker is also quite convenient, as 24Option withdrawals are payable at request. In one sentence, we’re confident that 24Option is a safe and worthwhile broker.

For example, there does not appear to be any meaningful discounts for larger volumes traded despite offering four different account types. But there are high thinkmarkets broker review fees for dormant accounts that can run to as much as €200 per month after six months. Finally, withdrawal fees of around 3.5% apply after the first withdrawal. On the bright side, there are no deposit, commission or financing fees. Customers who have used the 24option demo account reported mixed reviews. The majority of negative user comments across review websites could be put down to customers failing to properly understand the terms and conditions which are laid out in a fairly disjointed manner.

That being said, 24Option is an international trading brokerage and offers their services in English, Spanish, Russian, and Tadawul. 24Option’s brokerage services are marketed towards both beginner and advanced traders as their interface and platform are highly advanced yet simple and easy to use. They have been featured in numerous publications and won various awards over the years, crowning 24Option as “the worlds most awarded trading platform”.

Also, the 24option brand is registered with EU member states, under the European Union (EU) “Passporting” rule. Established in 2009 and have built a reputation as a reliable and transparent broker from that day forward. Choose ‘Real’ for a Live Account, fill out some basic details, check the two boxes and hit the ‘Start Trading’ button. Individuals have complained about their experience with 24Option, claiming that bad service is being provided.

Traders can participate in various competitions where they can win cash prizes and other things like tickets for Arsenal or Juventus football matches through company sponsorships. Other promotions and bonuses include gifts such as laptops, TVs, and other electronics. These bonuses are rewarded for certain amounts of trading volume and or deposit bonuses. The parameters change from time to time but are always explained on their website.

Other features such as automated trading or back-testing certain trading strategies are available via the MT4 platform, but not through the desktop platform. When clients wish to withdraw funds from their account, they must first go through a verification process. This involves providing a copy of an official form of identification, preferable a driver’s licence or passport. Secondary identification providing proof of residential address must also be provided, this could be a utility bill or credit card statement. If the withdrawal is to be made to a credit card, 24option requires you to provide a scan of the front and back of the card in question. Every time you wish to add a target account for withdrawals, this process needs to be repeated.

Their regulatory history suggests that they are a responsible company. The move away from the binary sector was designed to maintain their reputation. The excellence of this broker is even more evident in the number of organisations and businesses willing to enter into a partnership with them. They have offices situated in various countries around the world, such as France, Italy, Japan, Norway, South Africa, Taiwan, Russia, Canada, Malaysia, and Spain. With a multilingual support team, you should have no trouble in explaining any issues you may have to them. Also, they have won several international awards in recognition of its achievements.

For example, the desktop platform has customizable and transparent price lists for easy trading and execution. It allows for advanced charting with an “indicator wizard” that allows traders to build customized charts. It is also possible for traders to build a watch list simply by clicking on the star next to any currency pair.

The broker also provides its traders with the option to establish a demo account in a risk-free environment and test their tactics. The VIP account is limited to a small percentage of traders, as it requires a minimum account balance of $50,000. With a VIP account, you get five advanced lessons and five monthly webinars with experts, in addition to unlimited withdrawals. 24Option is primarily a binary and options broker created by the Cyprus Securities and Exchange Board in 2008 and has its offices in Limassol, Cyprus. In its beginning, 24Option began as a pure binary options broker, but it has recently added other, mostly commercial, assets and tools you can access on their website.

One of the ways they do this is through offering four different account types that come with slightly different features and perks. The company is regulated by both the FCA in the United Kingdom and CySEC in Cyprus, meaning that they must follow the guidelines set by these financial authorities. The regulatory bodies mentioned above are well known and respected and therefore provide traders using 24option with an extra layer of protection.

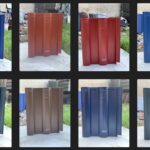

NGÓI BM

NGÓI BM NGÓI BM CHẤM BI

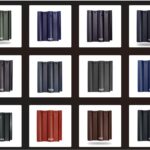

NGÓI BM CHẤM BI NGÓI GỐM SỨ

NGÓI GỐM SỨ ĐÁ TỰ NHIÊN

ĐÁ TỰ NHIÊN ĐÁ TỰ NHIÊN 10X20

ĐÁ TỰ NHIÊN 10X20 ĐÁ TỰ NHIÊN 15X30

ĐÁ TỰ NHIÊN 15X30 ĐÁ GHÉP TỰ NHIÊN

ĐÁ GHÉP TỰ NHIÊN KEO TRÉT TƯỜNG TRỘN SẴN

KEO TRÉT TƯỜNG TRỘN SẴN

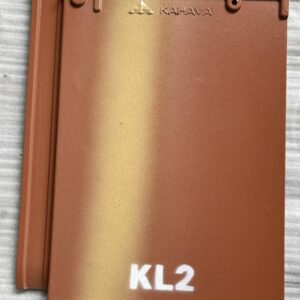

NGÓI PHẲNG KAHAVA

NGÓI PHẲNG KAHAVA