Its recorded value on the balance sheet is adjusted downward to reflect that it is overvalued compared to the market value. In addition to software solutions, emerging technologies like RFID (Radio Frequency Identification) and IoT (Internet of Things) are enhancing asset management practices. RFID tags can be attached to assets, allowing for real-time tracking and monitoring. This technology not only improves the accuracy http://nexusrus.com/kreativnye-veshhi-kotorye-tebe-neobxodimy-na-rabote.html of physical inventories but also provides valuable data on asset usage and maintenance needs. IoT devices can further enhance this by collecting and transmitting data on asset performance, enabling predictive maintenance and reducing downtime. By leveraging these technologies, organizations can optimize their asset management processes, ensuring that their fixed assets are utilized effectively and efficiently.

Operating vs. non-operating assets

- Fixed assets include buildings, computer equipment, software, furniture, land, machinery, and vehicles.

- Fixed assets appear on the balance sheet, where they are classified after current assets, as long-term assets.

- One key aspect of these standards is the requirement for detailed disclosures in financial statements.

- Most tangible assets, such as buildings, machinery, and equipment, are depreciated.

- Depreciation is found on financial statements like balance sheets, cash flow statements, and income statements.

A baking firm’s current assets would be its inventory (flour, yeast, etc.), the value of sales owed to the firm from credit extended (i.e. debtors or accounts receivable), and cash held in the bank. Its non-current assets would be the oven used to bake bread, motor vehicles used to transport deliveries, and cash registers used to handle cash payments. While these non-current assets have value, they are not directly sold to consumers and cannot be easily converted to cash. The register is usually subdivided into the various categories so that fixed assets are grouped together by nature, use or function.

Depreciation Entries:

- Once an impairment loss is identified, it must be recorded in the financial statements, reducing the asset’s carrying amount to its recoverable amount.

- The first tip is always to register correct and precise records of your fixed assets.

- They are noncurrent assets that are not meant to be sold or consumed by a company.

- In accounting, a fixed asset, also known as a capital asset or tangible asset, is a tangible long-lived piece of property or equipment a company plans to use over time to help generate income.

Conversely, a downward revaluation, often due to obsolescence or market downturns, can reduce the asset’s value, impacting profitability and equity. Therefore, it is crucial to conduct revaluations judiciously, often requiring the expertise of professional appraisers to ensure accuracy. Fixed asset accountants frequently interact with various http://shops-ru.ru/c282-1697.html departments, including finance, operations, and facilities management. Clear and concise communication ensures that all stakeholders are aligned and that asset-related information is accurately conveyed. This collaborative approach is essential for conducting physical inventories, resolving discrepancies, and implementing internal controls.

Classification and Depreciation of Fixed Assets

Damages may be visible if one were to inspect the asset, but an impairment related to market changes may not be visible. Regardless, an impairment should be recorded once a triggering event becomes known, not at the time of routine impairment testing. The asset value will be reduced with a credit and a loss will be recognized for the reduction of value. When a fixed asset can no longer be used in your business, you can write it off.

Accumulated Depreciation and Carrying Value

We do this by initially putting the purchase as an asset but depreciating the value over time. Yes, the salvage value may change due to changes in market conditions, technological http://kneht.com/4/?page=3 advancements, or changes in the asset’s condition. Training and maintenance costs, which are often a significant portion of the total expenditure, are expensed as period costs.

If you are accounting for fixed assets, you need to set a capitalisation policy. A capitalisation policy sets a cost threshold above which expenses become fixed assets. Fixed assets include property, plant, and equipment (PP&E) and are recorded on the balance sheet with that classification. Another method, the units of production approach, ties depreciation to the actual usage of the asset.

What are the advantages of fixed assets?

Here, we will look at a real-life example that is easy to grasp using the straight-line depreciation method. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Upgrade and enhancement costs should be expensed unless it is probable they will result in additional functionality.

NGÓI BM

NGÓI BM NGÓI BM CHẤM BI

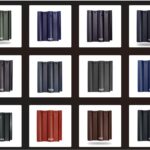

NGÓI BM CHẤM BI NGÓI GỐM SỨ

NGÓI GỐM SỨ ĐÁ TỰ NHIÊN

ĐÁ TỰ NHIÊN ĐÁ TỰ NHIÊN 10X20

ĐÁ TỰ NHIÊN 10X20 ĐÁ TỰ NHIÊN 15X30

ĐÁ TỰ NHIÊN 15X30 ĐÁ GHÉP TỰ NHIÊN

ĐÁ GHÉP TỰ NHIÊN KEO TRÉT TƯỜNG TRỘN SẴN

KEO TRÉT TƯỜNG TRỘN SẴN

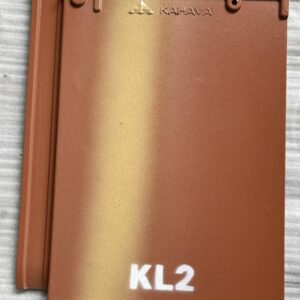

NGÓI PHẲNG KAHAVA

NGÓI PHẲNG KAHAVA